Equity Multiplier Measures the portion of total assets purchased through equity.

Average Collection Period The mean amount of time for a company to collect it's accounts recieivable, a measure of their credit and collections policies. Total Asset Turnover Measures the efficancy of a company in using it's total assets. Ratio Definitions Inventory Turnover Measures the liquidity of a company's inventory. Shareholder's Equity Amount invested by shareholders into the company. What is Non-current Asset Turnover Ratio This refers to level of contribution made by pure non-current assets towards sales or turnover generation. By default, the reporting period is 365 days (one year), but this can be adjusted for companies with non-standard fiscal year lengths e.g.- seasonal businesses that completely cease operations in the off-season. Sales for Reporting Period Sales over a specified period. Accounts Receivable Amounts owed to a company from customers who purchased a product or service on credit or a financing aggreement. Sales Gross revenue for all products sold, does not factor in any expenses. Inventory Total value of all unsold product. Includes materials, labor/ manufacturing costs, licensing fees, etc. Input Definitions Cost of Goods Sold Total of all expenses incurred in order to produce the product(s) being sold.

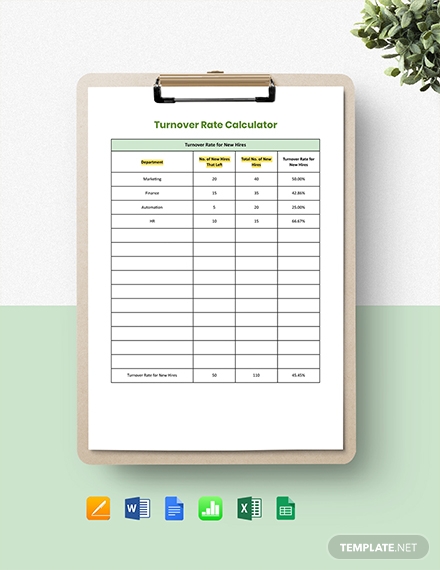

Operations of a business or organization - inventory turnover, total asset turnover, average collection period, and equity multiplier.

This calculator will find solutions for up to four measures of the

0 kommentar(er)

0 kommentar(er)